$80,000 Yield Pool for November sAID holders is live

sAID, GAIB’s yield-bearing asset with yield sourced from AI & Robotics tokenized financing deals, was launched on October 31st. Due to the launch mechanism of the sAID token, it didn’t inherently accrue value during its initial month of existence in November. sAID started accruing value from December onwards, and you can now follow this growth through our protocol dashboard.

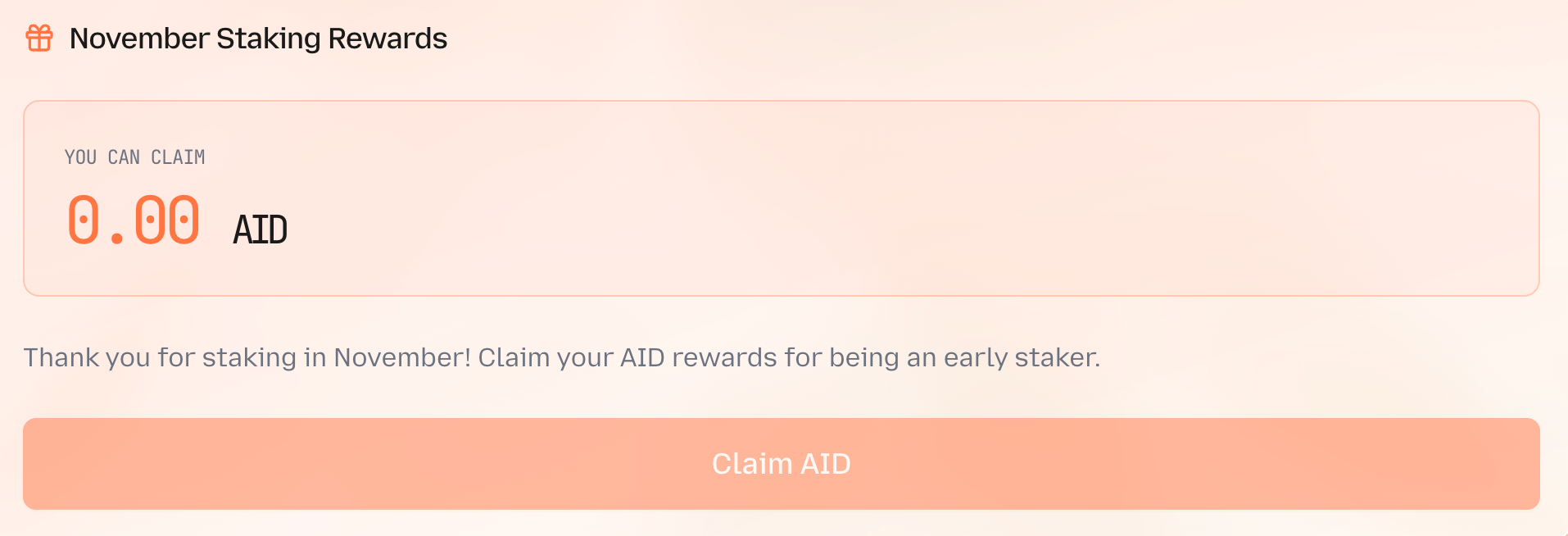

Today, we’ve enabled a one time only $80,000 yield pool paid in AID for holders of sAID during the month of November, available for claiming on https://aid.gaib.ai/portfolio.

What is sAID (staked AID)?

sAID is a liquid staking vault token (yield bearing) representing a share in a tokenized portfolio of AI infrastructure financings. It is minted by staking AID, and its value tracks the Net Asset Value (NAV) of the underlying portfolio.

Unlike AID, sAID is not pegged to $1.00. Instead, its price floats according to the portfolio’s performance and yield accumulation reflected by the NAV of the vault.

For more details about sAID, see our documentation.

$80,000 yield pool

Some AI and Robotics financing deals as covered in our transparency page have generated interest revenue for the protocol; today this revenue starts flowing into the community of sAID holders during November 2025.

An initial set of $80,000 paid in AID has been allocated to holders of sAID during the month of November. Users can now claim it on https://aid.gaib.ai/portfolio.

The yield has been allocated under the following eligibility parameters:

- Holders of sAID (0xB…A9F8) between November 1st 00:00 UTC and November 30th 23:59 UTC.

- Holders of YT assets for the sAID Pendle market.

- Pro-rata of time holding sAID or Pendle YT x USD value from a pool of $80,000.

- Remove sybil accounts with very small balances.

- Yield stops accruing from the day users unstake.

IMPORTANT NOTE: This is a one time only yield distribution event for holders during November 2025. From December onwards, sAID yield is distributed through its designed mechanism of value accrual into the asset itself as explained above.

Conclusion

We’re excited to offer this initial yield distribution to the community of sAID holders. These will be the first of many tokenized financing deals that will offer real-world value into the blockchain finance ecosystem, now accruing value into sAID natively as GAIB brings the AI infra and Robotics economies onchain.

Follow us on X(Twitter) and Linkedin for more exciting updates about GAIB.