A Technical Overview into AID and sAID

AID and sAID are launching on October 31st 2025! Today we’ve released an updated version of our documentation, going deep into our architecture.

This post is a summary of the most important information there.

For the full version, visit docs.gaib.ai

Intro

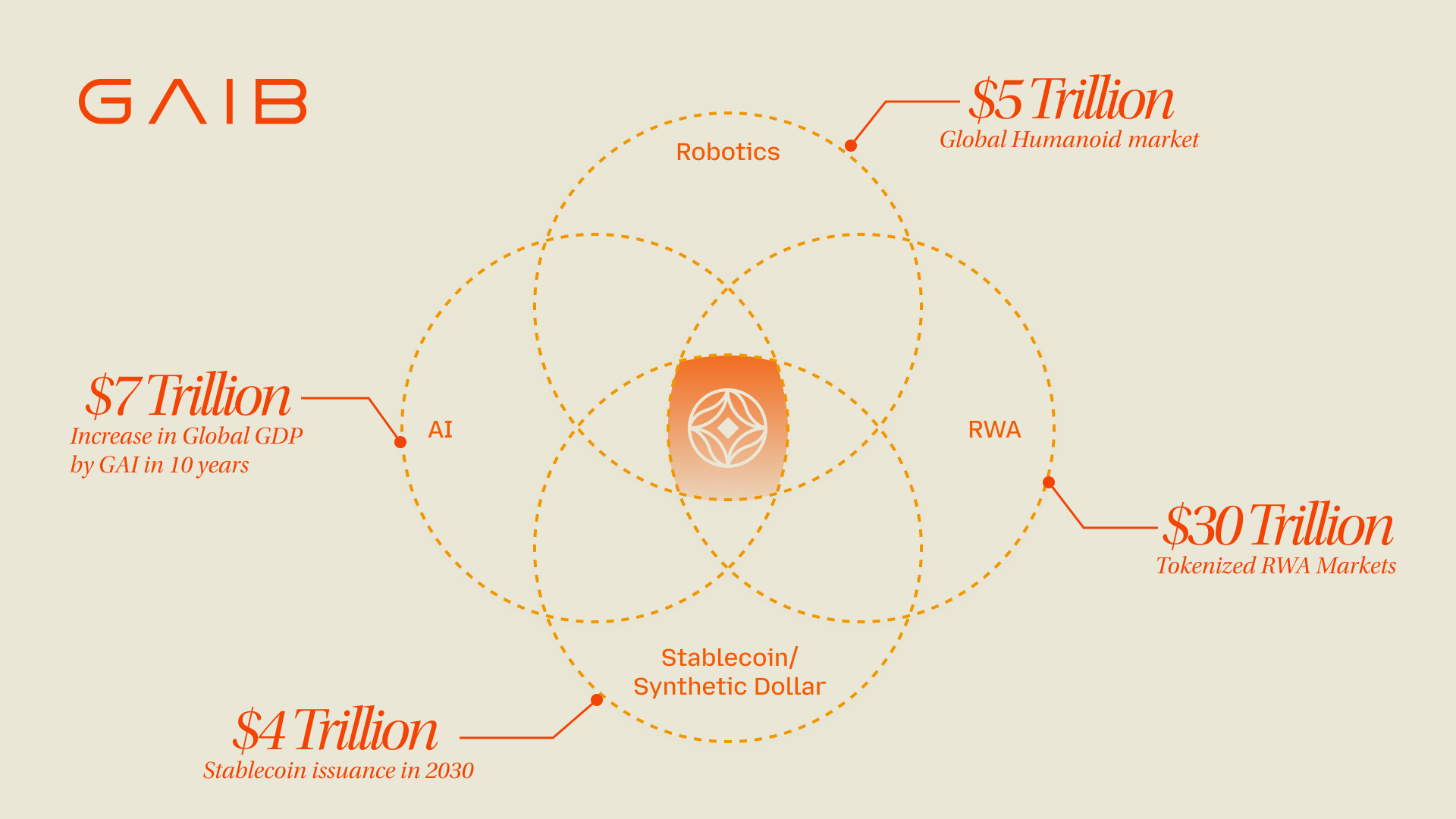

GAIB is the world’s first economic layer for AI infrastructure, transforming real-world AI assets—GPUs, robotics, and AI energy systems—into tradable, reward-bearing onchain instruments. By bridging decentralized finance (DeFi) liquidity with AI infrastructure assets, GAIB unlocks a trillion-dollar opportunity at the intersection of AI, Robotics, RWA & DeFi.

AI Dollar (AID) is the first product built on GAIB’s economic layer, designed as a synthetic dollar fully backed by the U.S. treasury and stable assets. sAID (staked AID) is the receipt token issued when AID is staked into GAIB’s ERC-4626 vaults, representing the proportional ownership in GAIB’s diversified portfolio of real-world AI compute infra & Robotics financing deals and a reserve of treasury bills. Through sAID, investors gain direct exposure to real-world AI infra with sustainable AI-driven yields, while preserving liquidity to enable broader participation across DeFi markets.

Why GAIB

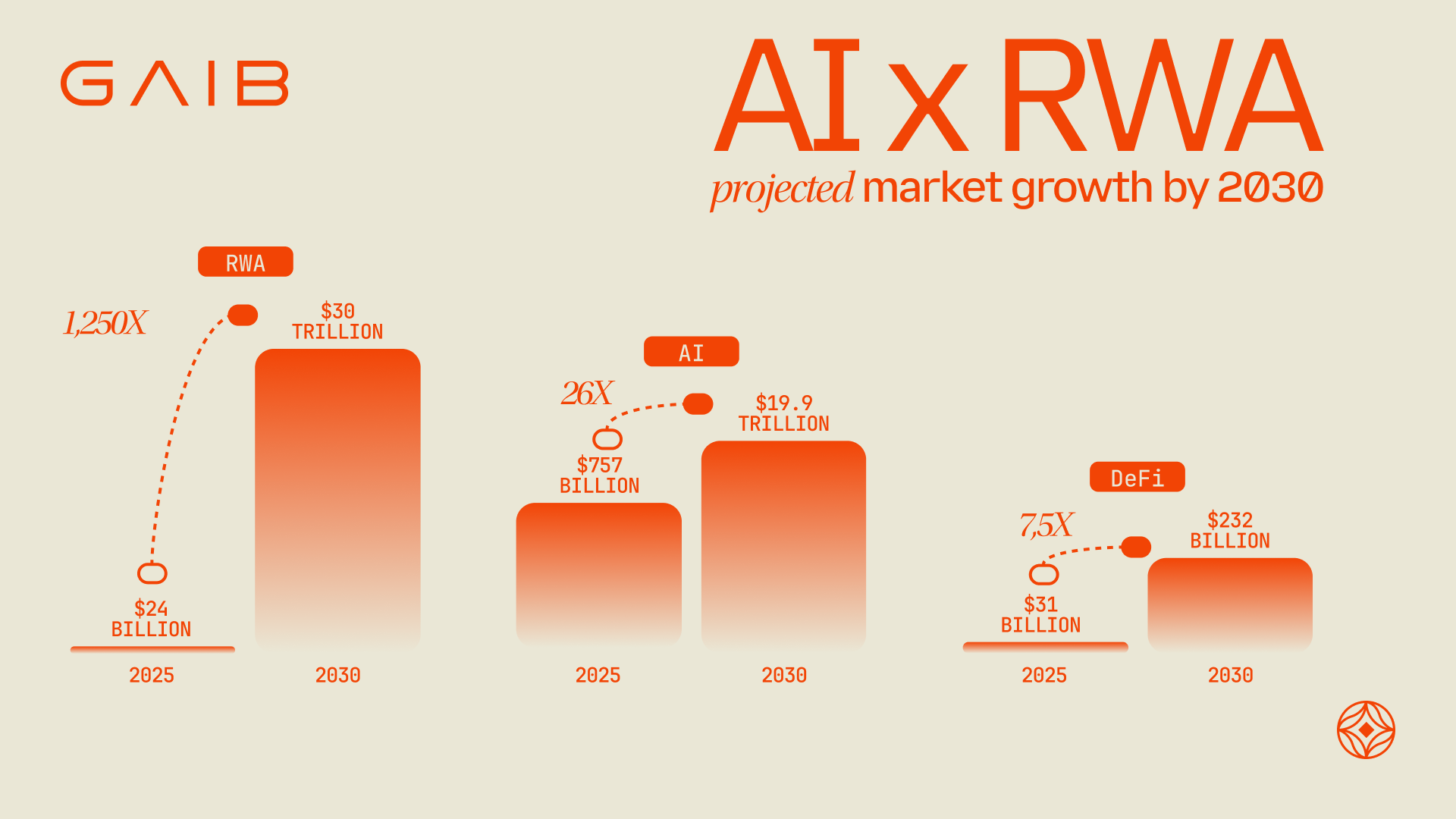

GAIB operates at the convergence of three transformative trends: Real-World Assets (RWA), Artificial Intelligence (AI), and Decentralized Finance (DeFi).

This intersection — RWAiFi — represents one of the most compelling growth opportunities in the global economy. By tokenizing real-world AI assets and leveraging decentralized infrastructure, GAIB is positioned to unlock unprecedented access to wealth creation on a global scale.

With GAIB, you ride on the wave crest of all three inevitable trends at the same time.

What Problems Are We Solving?

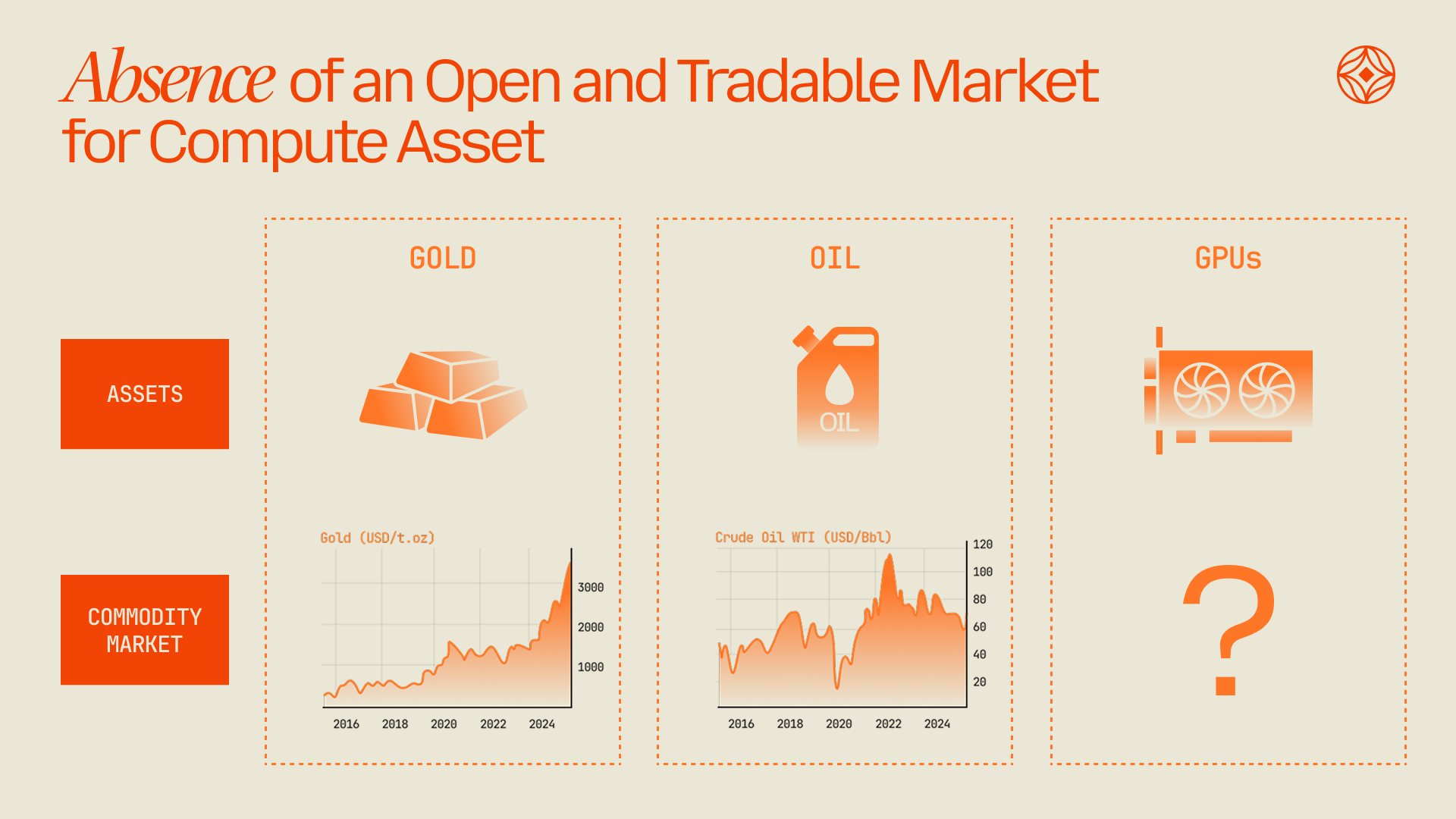

- Absence of a Liquid Compute Asset Market

Compute as commodities is like gold before the 1970s, lacking a liquid, transparent, and efficient market. Compute assets such as enterprise-grade GPUs are in extremely high demand but cannot be traded or leveraged effectively, limiting their economic value proposition.

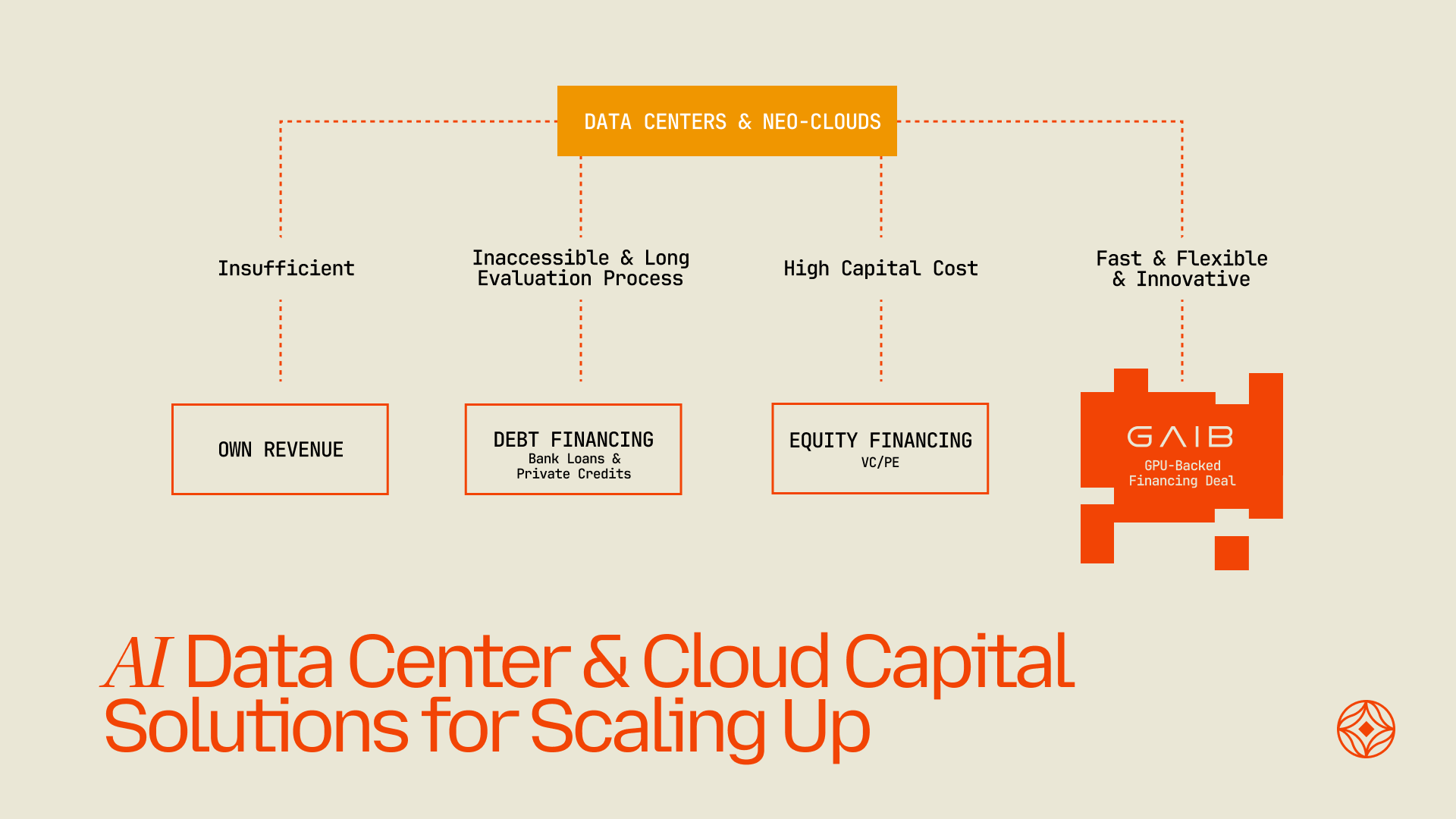

- Capital Barriers for Cloud / Data Centers

Cloud / data centers—which collectively house trillions of dollars’ worth of compute assets—are essential to delivering the raw processing power that underpins modern AI. Yet they are also among the most capital-intensive businesses in tech, with the leading cloud service providers (AWS, Azure, Google Cloud) investing tens of billions of dollars annually in data center construction, networking infrastructure, and high-performance GPUs.

As demand for AI workloads grows exponentially, the need to finance and refinance these expensive expansions becomes a critical bottleneck—one that, without innovative financing solutions, could limit how quickly the cloud / data centers can scale to meet the world’s computing demands.

- Lack of Real Yields & Real Assets in the Crypto Space

Crypto faces a significant challenge: a shortage of real-yield assets. Many of the high returns advertised in crypto rely on token inflation, which isn’t sustainable over the long term. As Vitalik mentioned, to break the DeFi Ouroboros, “... the yield is coming from, or could come from, that's rooted in something external”.

This lack of secure, liquid, and high-yielding real-world assets onchain makes it harder for the industry to attract long-term capital and integrate more deeply with traditional finance. Without better, more accessible real-yield options, crypto risks remaining dependent on inflation-based rewards, which can undermine both its credibility and its future growth.

- Vacuum in Direct Channels for AI Investments

Compute captures the majority of value in the AI supply chain. For large AI projects, the spending on compute can be a substantial fraction of total cost—often cited anywhere from 30% to 60% of the overall operational spending for AI (covering both training and inference).

The global cloud compute sector is worth $600 billion in annual revenue as of 2024, with a compound annual growth rate (CAGR) of 12–18% over the next five years.

However, for individual and institutional investors, the options to participate in such a substantial, high growth, and high margin sector are quite limited. Beyond purchasing AI-related stocks like NVIDIA, there are very few avenues to directly invest in the compute assets that drive the AI revolution.

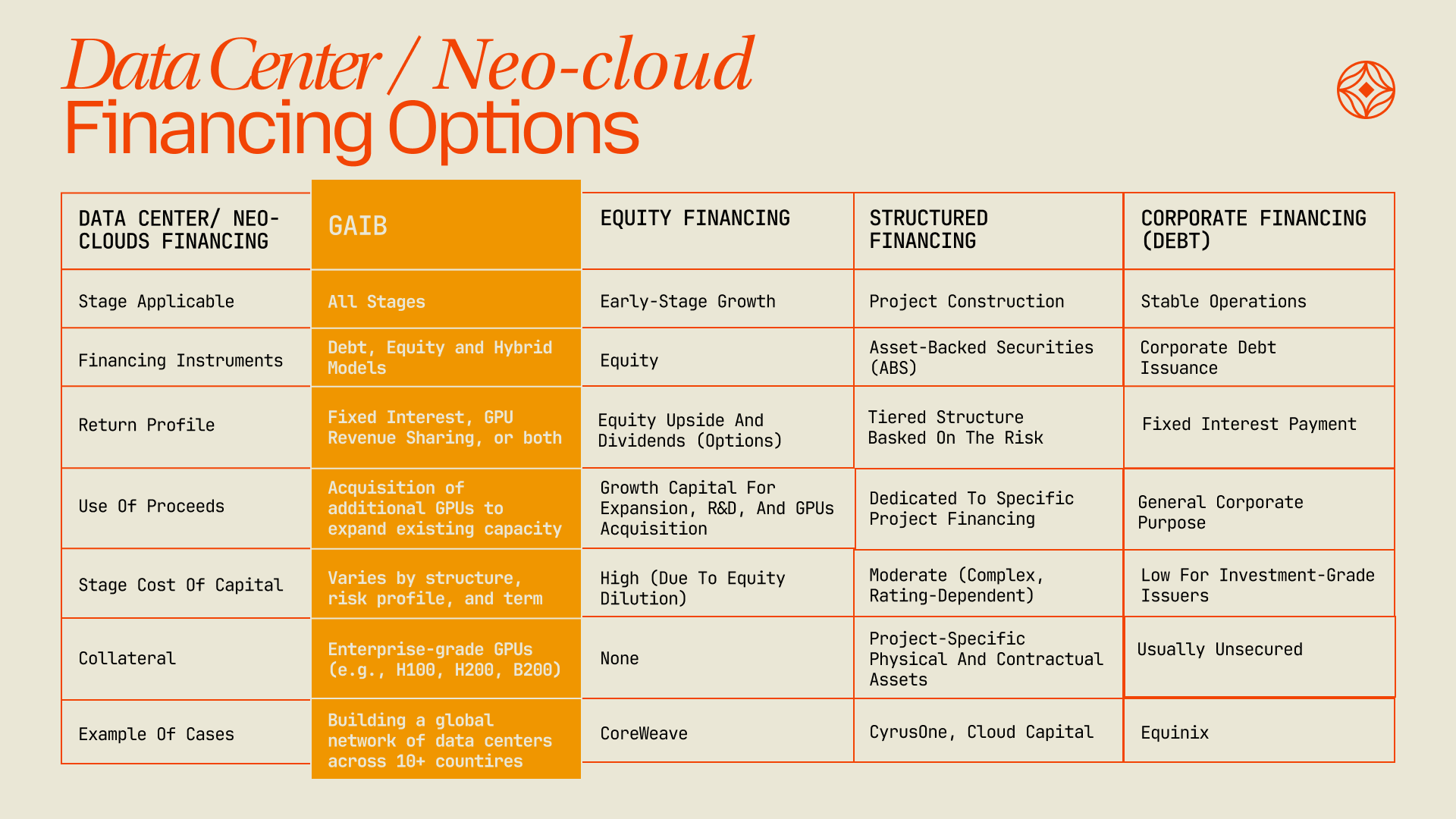

Why GAIB Matters to Data Center/ Neo-cloud

- Faster and More Flexible Funding

Data centers often face capital constraints when acquiring high-performance GPUs and expanding infrastructure to scale faster and meet soaring demand. GAIB’s platform removes many of the obstacles tied to conventional financing—lengthy approval processes, high interest rates, and rigid terms—by transforming GPUs and their future cash flows into tradeable tokens.

- Lower Costs and Greater Stability

Unlike traditional bank loans or private lending, GAIB’s tokenization model could reduce financing costs and diversify funding sources. By tapping into a global pool of investors, cloud / data centers gain more stability and resilience in a rapidly evolving AI economy.

Why GAIB Matters to Investors

- Direct Exposure to AI & Robotics Compute

Investing in Big Techs such as Meta or Amazon, may seem like a proxy play on AI, but in reality, it means buying into a basket of business lines—advertising, e-commerce, cloud computing, and more—without direct exposure to AI compute economics.

GAIB offers investors a more targeted route by tokenizing enterprise-grade GPUs—such as NVIDIA’s H100, H200 or GB200—linking returns directly to GPU-centric reward streams.

- Flexible Financial Strategies

From conservative hedging to higher-risk speculations, GAIB’s integrations with various DeFi protocols creates a range of derivative products and use cases for tokenized GPUs and AID. Whether investors are seeking stable, predictable yields or aiming to exploit market volatility, GAIB lets them tailor their strategies, catering to a spectrum of risk-reward opportunities.

AID and sAID are designed to be composable across the DeFi ecosystem, such as but not limited to: Yield Trading, LP, Collateral in Money Markets, Restaking, Derivatives, Cross-Chain Liquidity and many others.

Our products

What is AI Dollar (AID)?

AI Dollar (AID) is an ERC-20 synthetic dollar fully backed by the U.S. Treasuries and stable assets and minted 1:1 by depositing USDC, USDT and other accepted stablecoins. It’s the first product built on GAIB's economic layer, an entry point to GAIB’s tokenized portfolio of AI infrastructure, and a base currency in the broader DeFi ecosystem.

1. How to Acquire AID

- Minting: Whitelisted users can mint AID by depositing USDC, USDT, or other supported stablecoins through the GAIB AID minting contract.

- Swapping: Non-whitelisted users can acquire AID by exchanging stablecoins on leading DEXes.

2. How to Exit AID

- Whitelisted users can redeem AID for underlying collaterals (USDC, USDT and other accepted stablecoin assets) via the GAIB AID redemption contract.

- For non-whitelisted users, AID can be exchanged for USDC, USDT and other stablecoin assets on leading DEXes.

3. What Can You Do with AID

- Staking: Users can stake AID to receive sAID, a liquid staking token representing shares in the AI Infrastructure portfolio. Rewards accrue via a floating exchange rate between sAID and AID, allowing stakers to benefit from the growth in the underlying assets (see sAID below).

- Lending and Borrowing: GAIB will integrate with major lending protocols to let users deposit AID into lending pools and earn additional returns as liquidity providers.

- Trading: A variety of trading pairs will be introduced, pairing AID with other major currencies.

- Liquidity Provisioning: Liquidity provision in AMM pools will be incentivised.

What is sAID?

sAID (staked AID) is a liquid staking, yield-bearing vault token, an ERC-20 token representing a share in a ERC-4626 tokenized portfolio vault of AI & Robotics infrastructure financings. It is minted by staking AID, and its value tracks the Net Asset Value (NAV) of the underlying portfolio.

Unlike AID, sAID is not pegged to $1.00. Instead, its price floats according to the portfolio’s performance and yield accumulation reflected by the NAV of the vault.

1. How to Acquire sAID?

sAID can be minted only by staking AID, at the current Deposit NAV. The capital in the sAID vault will be deployed into AI infrastructure financing (GPUs, Robotics, etc.) and also a stable reserve for liquidity buffers (T-bills and stablecoins).

The sAID Vault conforms to the ERC-4626 Tokenized Vault Standard, an extension of ERC-20 that defines how vaults calculate deposits, unstaking, and yield accrual. This standard ensures transparent, standardized performance accounting and makes sAID fully interoperable with DeFi protocols that support ERC-4626 vaults — including lending, structured-yield, and derivative platforms.

When users stake AID, they are issued sAID, a tradable token representing their proportional share of the vault. The ERC-4626 architecture automatically manages how the sAID token accrues value from the underlying financing deals, while the ERC-20 interface ensures it remains freely transferable and composable across DEXs and integrated DeFi applications.

2. How to Unstake sAID?

- Unstake via Withdrawal Manager: Submit a withdrawal request through the AID Staking Portal. Requests are processed on a 30-day cycle at the Unstaking NAV, fulfilled based on the FIFO principle.

- Trade on DEXs: Sell sAID at the prevailing market price for immediate liquidity, bypassing the withdrawal queue.

The unstaking dashboard will provide real-time data comparing Unstaking NAV and market price, allowing users to choose the most efficient liquidity path.

3. What Can You Do with sAID?

- Earning Rewards: Simply holding sAID entitles users to ongoing rewards, as it is a yield-bearing token backed by real-world AI demand.

- Trading: GAIB will introduce multiple trading pairs that link sAID with major currencies.

- Liquidity Provisioning: Users can supply sAID to AMM pools, earning both transaction fees and GAIB token incentives.

- Principal and Yield Tokens (PT/YT): As a yield-bearing asset, sAID will be integrated into specialized yield-trading protocols such as Pendle.

- Lending and borrowing: GAIB will integrate with leading lending protocols such as AAVE, Morpho, and Euler, to enable sAID holders to borrow major stablecoins such as USDC and USDT against their sAID.

GAIB Solutions

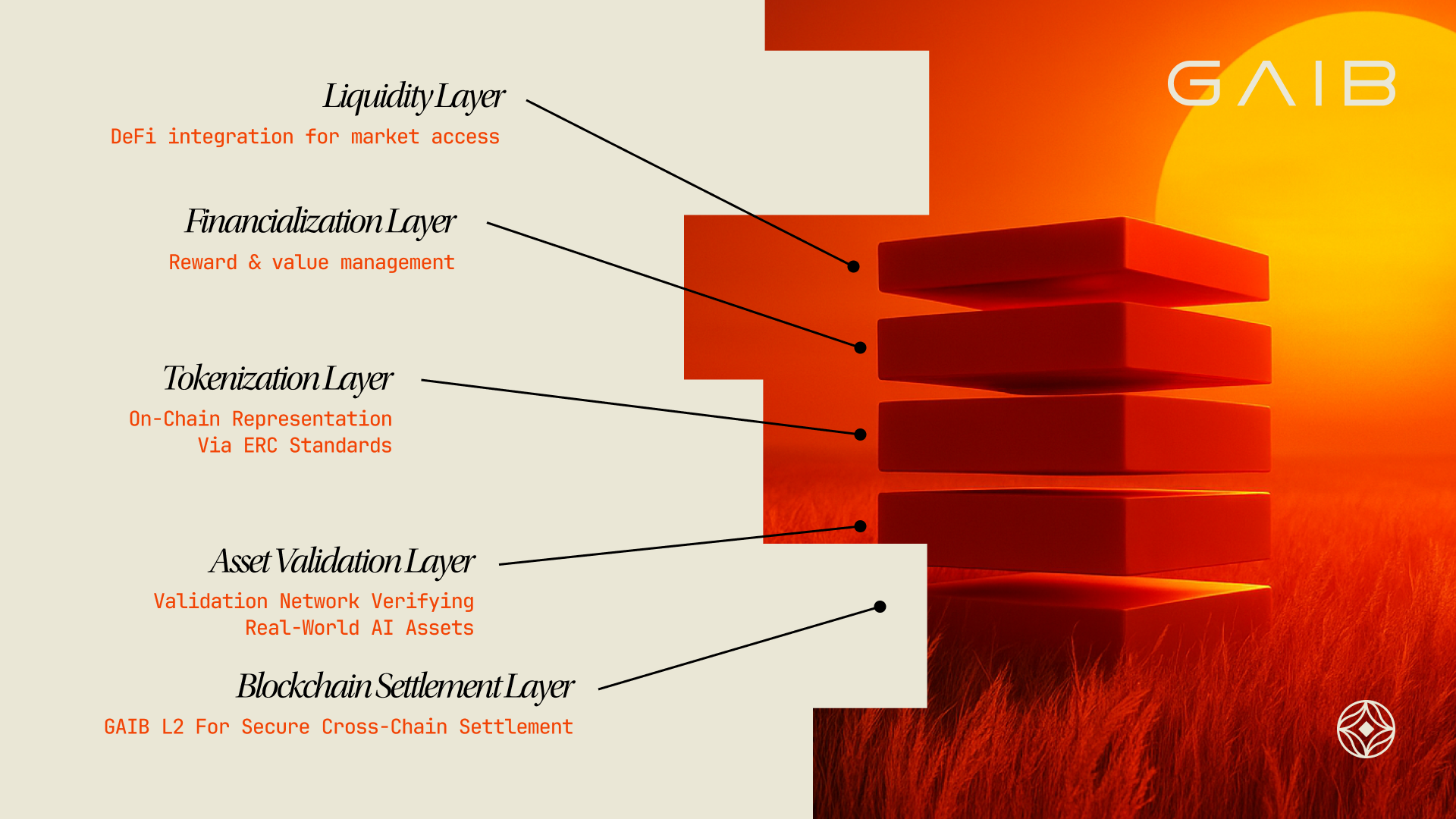

At the heart of GAIB lies a modular, interoperable architecture designed to seamlessly transform real-world AI infrastructure—from GPUs to robotics—into verifiable, programmable on-chain assets that power a decentralized AI economy.

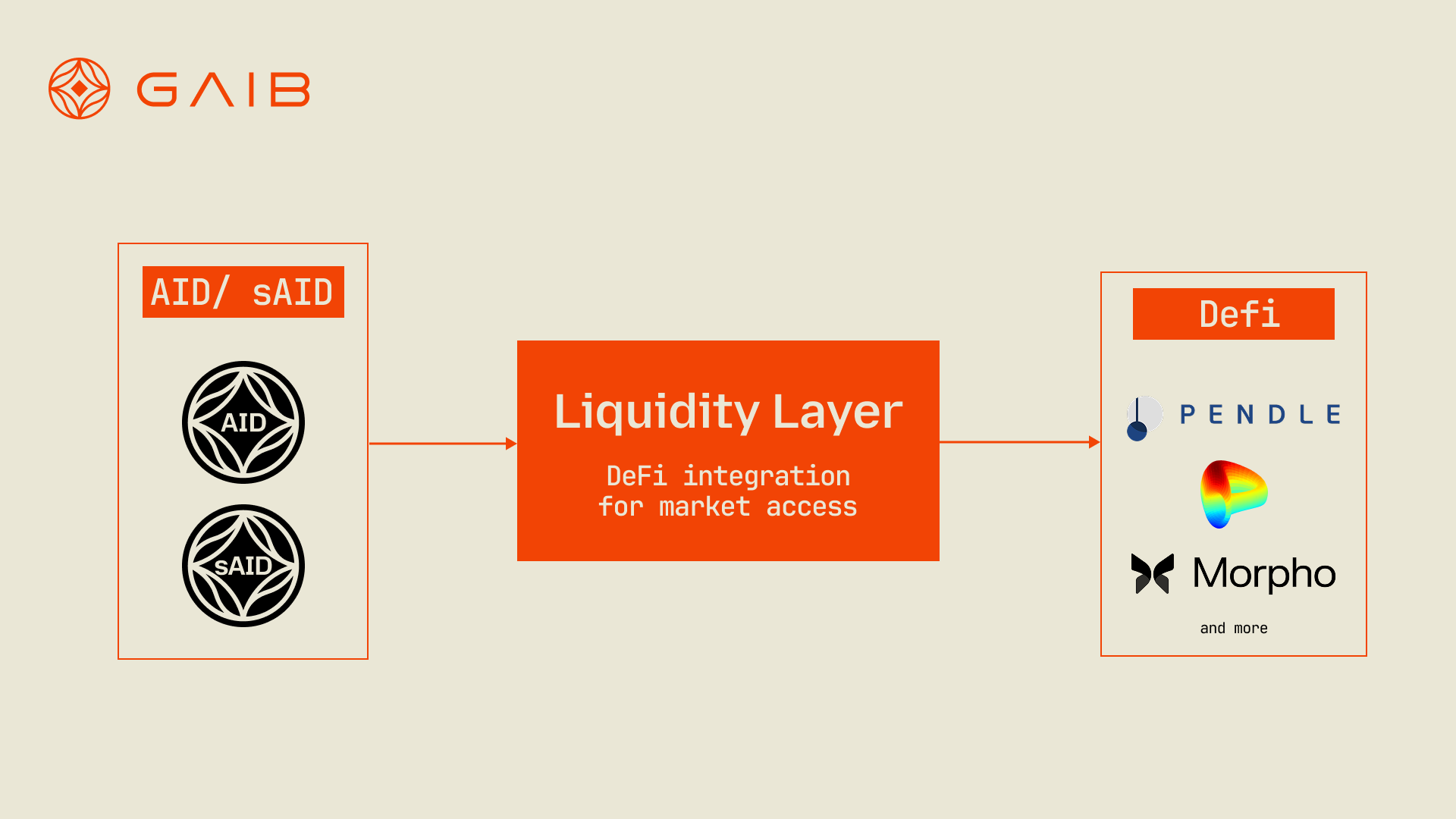

Liquidity Layer (LIQUID)

The LIQUID layer serves as the external interface between the GAIB ecosystem and the broader DeFi landscape, ensuring that tokenized AI infrastructure—once validated, tokenized, and financially synchronized—remains liquid, composable, and accessible across global on-chain markets.

At its core, LIQUID integrates AID, the AI Synthetic Dollar, and its liquid staking token (sAID) deeply into leading DeFi protocols. Users can stake, lend, borrow, or trade AID and sAID across supported markets, unlocking frictionless capital mobility and maximizing yield opportunities. Seamless conversion between AID ↔ sAID enables participants to dynamically manage exposure, balancing liquidity with real-world AI yield.

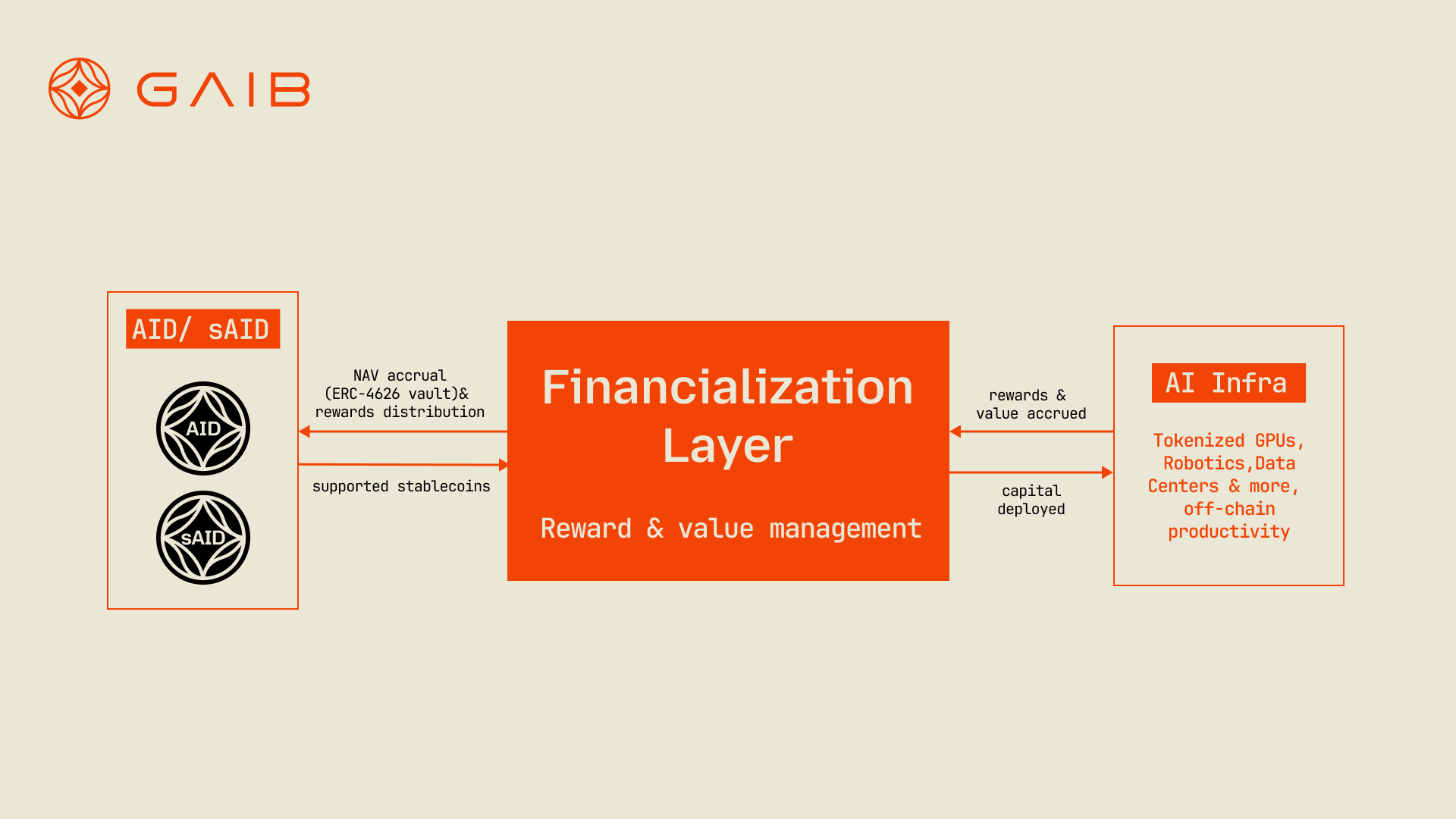

Financialization Layer (REWARD)

The REWARD layer forms the economic core of the GAIB protocol — the engine that transforms verified, off-chain productivity from AI infrastructure into programmable, on-chain value. Acting as the bridge between decentralized capital and real-world operations, REWARD ensures that all economic activity within the GAIB ecosystem is transparent, rule-based, and cryptographically verifiable.

Through REWARD, GAIB translates real-world AI infrastructure assets — such as enterprise-grade GPUs, robotics systems, and data-center financings — into digital AI portfolio tokens like sAID. Each sAID represents a proportional share of a diversified AI asset portfolio, whose value accrues automatically as verified rewards and values from AI infrastructure flow back on-chain. Built upon the ERC-4626 Tokenized Vault standard and LayerZero’s omnichain fungible token (OFT) framework, these assets achieve cross-chain liquidity, transparency, and composability across the broader DeFi landscape.

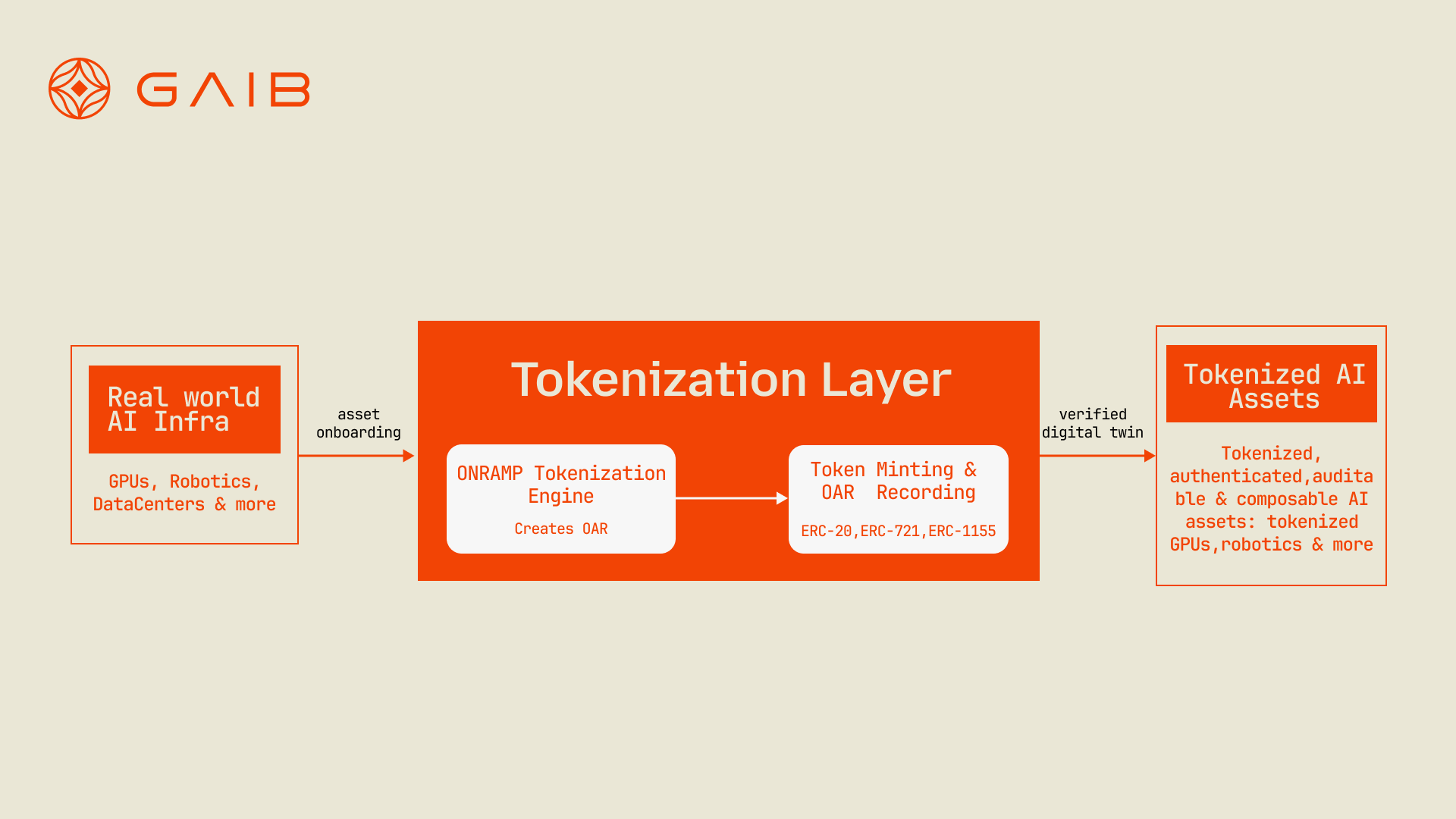

Tokenization Layer (ONRAMP)

The ONRAMP layer is GAIB’s bridge between real-world AI infrastructure and the blockchain. It converts assets like GPUs, robotics, and data-center equipment into digital on-chain representations that are auditable, composable, and interoperable across DeFi.

Tokenization Process:

- OAR Creation: Each real-world asset becomes an On-Chain Asset Representation (OAR) containing its unique ID, token standard (ERC-20, 721, or 1155), metadata, timestamps, and optional performance metrics.

- Token Minting: Once the OAR is verified, ONRAMP mints tokens that mirror the asset’s characteristics:

- ERC-721 for unique assets (e.g., GPUs, robots)

- ERC-1155 for grouped or modular assets

- ERC-20 for pooled or fungible compute resources Each token embeds the verified OAR metadata to ensure authenticity and composability.

Adaptive Representation:ONRAMP supports multiple token standards, each linking back to the OAR through interoperable metadata, allowing seamless integration with DeFi markets, analytics tools, and supply-chain systems.

Integrity and Compliance:

- Immutable Provenance: All token data and creation records are permanently on-chain.

- Programmable Metadata: Ownership, classification, and performance are embedded directly in the token.

- Automated Governance: Smart contracts handle minting and updates consistently.

- Composability: ONRAMP tokens can move across GAIB’s layers and external DeFi protocols.

Interoperability:ONRAMP receives verified data from PROOF, passes standardized metadata to REWARD, and interacts with LIQUID for cross-layer liquidity—linking real AI infrastructure with GAIB’s entire economic system.

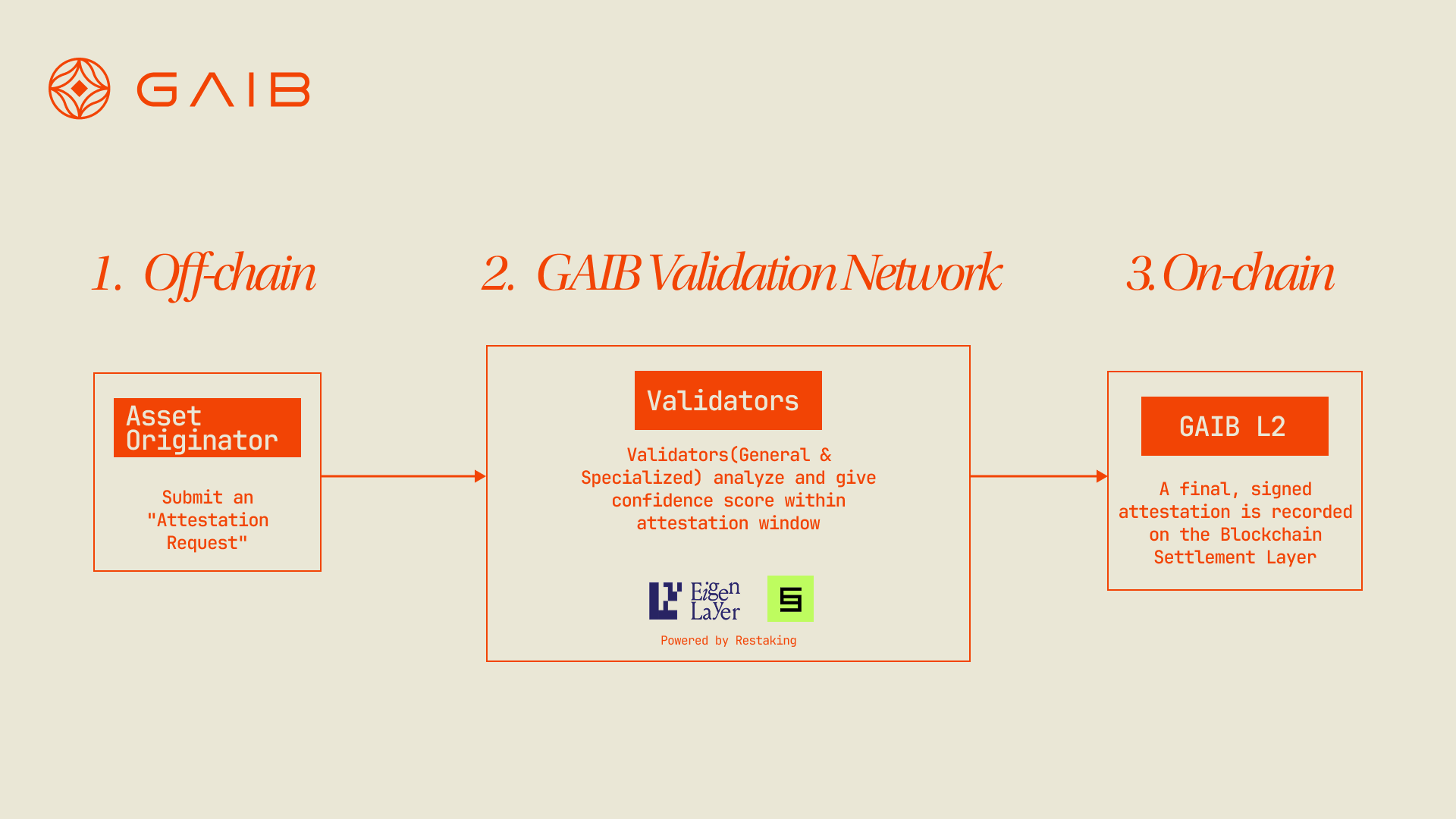

Asset Validation Layer (PROOF)

The PROOF layer serves as the decentralized trust bridge between the physical and digital worlds of AI infrastructure. It verifies, attests, and maintains the authenticity of all off-chain assets entering the GAIB ecosystem. Architected as the GAIB Validation Network leveraging EigenLayer and Symbiotic, PROOF ensures every on-chain asset represents a verifiable and legally recognized real-world counterpart, preserving the integrity of tokenized AI infrastructure.

The PROOF layer continuously validates that GPUs, robotics systems, and data centers are operational, correctly located, and actively performing, ensuring every on-chain record corresponds to a living, productive asset.

Validation Network

- General Validators: Stake $GAIB or restaked ETH to validate data and maintain consensus.

- Specialized Attestors: Legal, technical, and financial experts verifying ownership, equipment status, and performance.

Orchestration Network: connects directly to AI infrastructure nodes, verifying metrics like location, latency, bandwidth, and memory health, producing a continuous on-chain telemetry feed.

Shared Security via EigenLayer and Symbiotic: provides multi-layered defense and validator honesty across chains like Ethereum, Arbitrum, and Base.

Validation Workflow: Validators review asset data, assign confidence scores, and aggregate BLS signatures into a verified latestAttestation, recorded on the Settlement Layer. Dishonest actors are slashed.

Each verified asset generates an Onchain Asset Representation (OAR) containing identifiers, ownership, and attestation data — cryptographic proof of authenticity.

Blockchain Settlement Layer (NETWORK)

The Blockchain Settlement Layer is GAIB’s canonical record-keeping system. It provides an immutable, censorship-resistant ledger for all validated asset states and economic events, anchoring On-Chain Asset Representation (OAR) objects onto a cryptographically secure and auditable infrastructure.

Key Features:

- Immutable Registry: Every validated asset update is permanently stored as a timestamped OAR transaction.

- Canonical Truth: Only attestations signed by the active validator set can modify OAR state, ensuring records match verified real-world data.

- Blockchain-Agnostic: Designed for deployment across ecosystems like Ethereum, Solana, and L2 networks for maximum interoperability.

GAIB Chain (L2 Settlement Hub):Built on the OP Stack, GAIB’s Optimistic Rollup inherits Ethereum security while offering higher throughput and lower costs.

- EVM-Compatible: Seamless integration with Ethereum contracts and tooling.

- Superchain Integration: Natively interoperable with Base, Optimism, and other OP Stack L2s for shared liquidity and bridging.

- Dedicated Blockspace: Ensures stable fees and uncrowded processing for OAR updates and validator settlements.

Multi-Chain Interoperability:Through LayerZero OFT standard or IBC-style messaging, OAR updates can sync across chains, maintaining:

- State Consistency — verified data reflected everywhere

- Supply Integrity — no duplication of GAIB-backed assets

- Composability — GAIB tokens usable across DeFi and exchanges

Conclusion

Now you know more about AI Dollar (AID) and sAID and what’s coming for the GAIB ecosystem!

If you have any further questions, let us know on X or Discord and we’ll be happy to answer them.