Tokenizing $15M and $5.4M worth of Robotics and GPU assets

Today we announced our first GPU tokenization deal in partnership with Siam AI, Thailand’s leading cloud provider and one of the first sovereign NVIDIA Cloud partners.

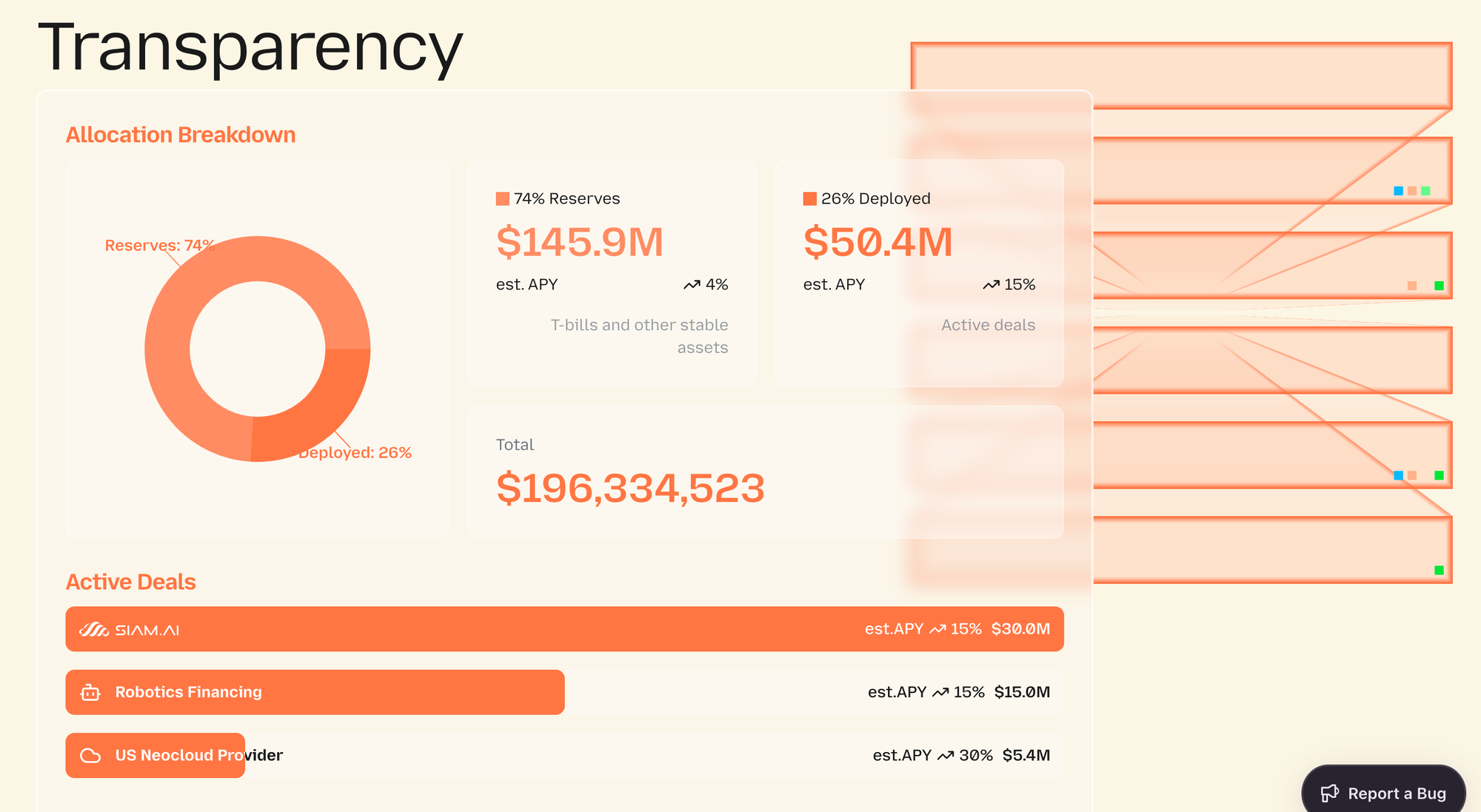

Two other deals are currently active for $15M and $5.4M with Robotics and Neocloud partners respectively, bringing our total deployed capital to $50.4M and a combined weighted APR of ~16%.

This is a major step towards providing users with investment opportunities in the AI and Robotics private credit markets, that will offer attractive yields while staying liquid through our upcoming AID and sAID tokens.

GPU & Robotics tokenization

Since the dawn of GAIB, our mission has been clear: enabling investors to participate in the economy of the future: compute. After $79M in pre-deposits, we’re excited to unveil our first deals to our depositors.

AI data centers, CSPs and similar operators struggle to get financing: it’s too risky for TradFi and the terms offered by private credit firms are too aggressive. The GAIB economic model enables good financing terms for builders as well as attractive capital opportunities for investors.

As we built this model, we have incorporated a new line of investment: Robotics, a market projected to grow to $185.37B by 2030, and that will also offer excellent investment opportunities.

These deals have a short term maturity, ending at the end of the Final Spice, to ensure full liquidity and transparency as we launch AID and sAID and enable withdrawals from the campaign.

Transparency portal

With these deals we launch our transparency portal, a look into our existing and upcoming AI & Robotics financing agreements for our community to see, you can visit it at aid.gaib.ai/transparency.

You can use this portal as the source of truth in our capital deployment efforts and as a result the state of yield potential in the GAIB protocol.

As initially planned, we target ~70% capital deployment into AI & Robotics deals, while keeping the remaining capital as reserves in US Treasury bills yielding ~4% APY.

Conclusion

The GAIB protocol moves at full force towards launch, today introducing our first GPU financing deals, cementing our business model. We are excited to share them with our community and looking forward to sharing further developments through and beyond the launches of our AID and sAID products.